By excluding debt from the calculation, prospective investors can do an apples-to-apples comparison of different investment opportunities.

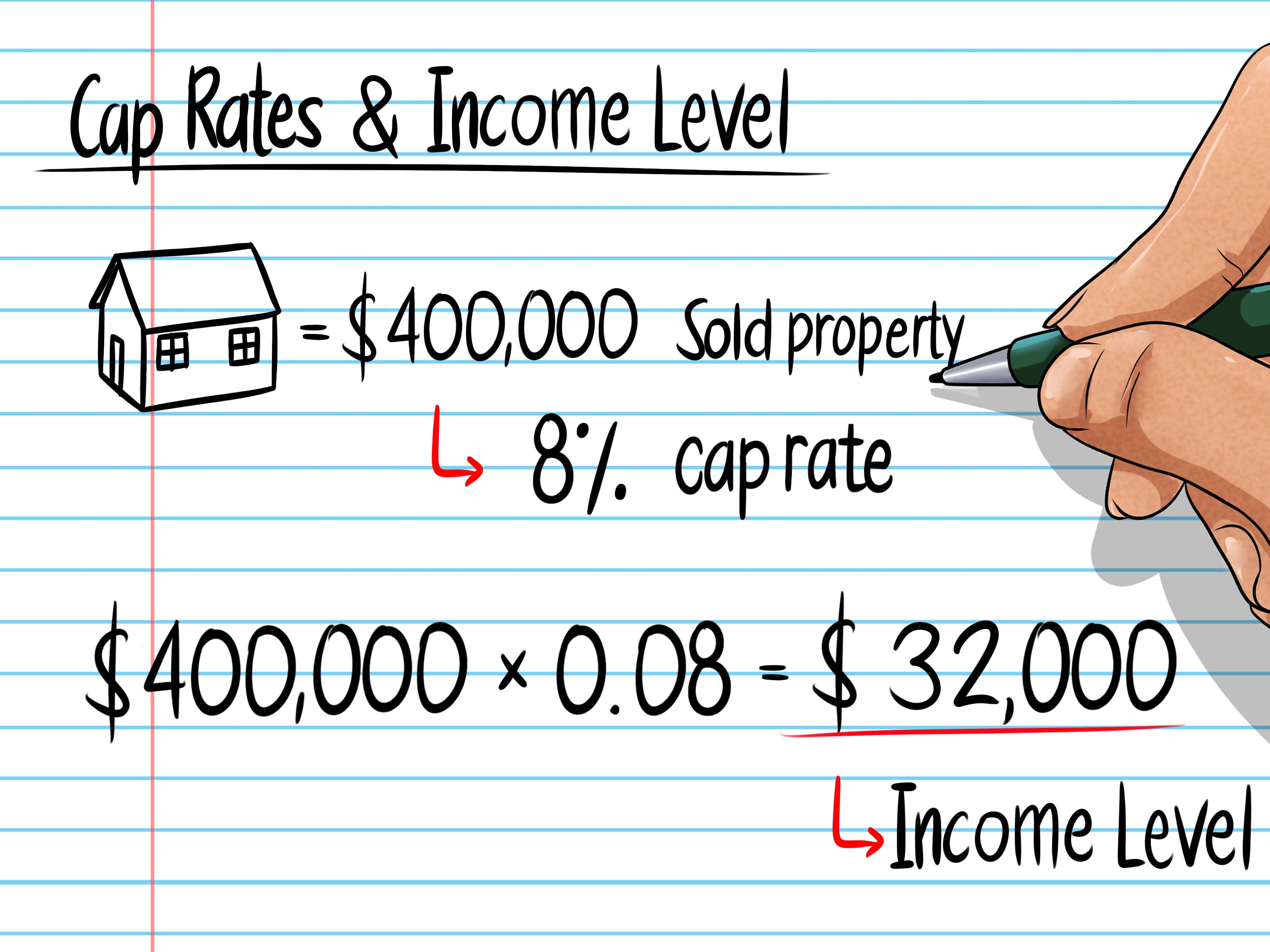

This is one of the reasons why cap rates are such a valuable tool for investors. It is important to understand that debt is not part of the cap rate calculation. The property value is typically the seller’s asking price for the property, or the purchase price the investor is expecting to pay for the property. The net operating income (NOI) is usually the actual NOI for the property over a one-year period. Net Operating Income / Property Value or Cost = Cap Rate Terminal Cap RatesĬap rates are calculated using a specific formula. For example, if in a particular geographical area, apartment buildings of the same age and caliber are selling for 5 caps, then a building with $1 million of net operating income will be valued at $20 million. Similarly, cap rates can be used to calculate the value of a building. For example, a building with $500,000 of net income that cost $10 million to purchase will be said to have a 5% cap rate. The cap rate for a building is derived by dividing the net operating income by the price or total cost of the building. The cap rate is expressed as a percentage that varies according to asset class, quality of asset, stage of the cycle we are in, and other factors, and have an inverse relationship to property value – the higher the value, the lower the cap rate, and vice versa. Knowing a property’s cap rate is one way for investors to compare opportunities. Simply stated, a cap rate (technically, “capitalization rate”) is a formula used to estimate the potential return an investor will make on a property.

The term “cap rate” is often used by commercial real estate investors. Related: The Benefits and Basics of Real Estate Funds What Are Cap Rates?

0 kommentar(er)

0 kommentar(er)